One thing we all have in common is that, at some point in our careers, it will be time to step off the bridge or out of the cockpit for the last time. For most, it will be a bittersweet moment, but in our hearts, we will realize that there is a lot more ahead of us that remains to be seen and enjoyed. I’m referring to the stage in life that we call retirement.

Fail to Plan, Plan to Fail

Retirement is something we should all take the time to prepare for. There are many cliches when it comes to retirement planning, and one of my favorites is that people don’t plan to fail, they fail to plan. Here are some basic facts that you can use when the day comes.

Let’s define the most commonly used retirement accounts that most individuals utilize:

A traditional IRA is a type of individual account that allows your investments to grow tax-deferred. The contributions you make to these accounts are pretax dollars, and the gains will be taxed when they are withdrawn. The maximum amount you may contribute annually is $6,000, or $7,000 if age 50 or older. The traditional IRA is the most popular retirement account available.

A Roth IRA is the second most popular retirement account. The difference between the Roth and traditional IRA is the tax treatment. In a Roth, your contributions are after-tax dollars, meaning you have already paid income tax on these funds, so the investments will grow tax-free. When you retire and start living off the gains, there will not be any taxes on the distributions. The contribution amounts are the same as a traditional IRA.

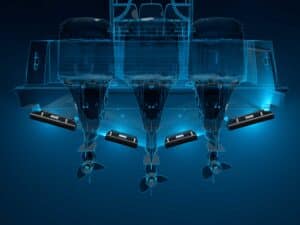

Watch: Stay on a hot bite with your electronics.

The traditional and Roth accounts are similar, with the only difference being the way the funds are taxed. Over the years, I have had many conversations with tax advisers and CPAs to determine which one is most beneficial, and there is no one clear choice. It depends on the investment, where we are in the market cycle, and your time left before retirement. The best feature both of these have is the ability to purchase any type of investment. Typically, investors will buy basic mutual funds or stocks, but if properly planned, investors can buy just about anything: collectible cars and art, real estate, actual gold and silver; an investor can really be creative with traditional and Roth accounts.

A 401(k) is a corporate plan. If you are lucky enough to have access to a 401(k) plan, this is by far the best opportunity to save money. When you contribute to a 401(k), the funds typically come right out of your paycheck, which will help you stay disciplined in making contributions. One of the best features of a 401(k) is that most employers will match your contribution up to a certain percentage, usually 3 to 5 percent. We call this free money. The contribution limit in 2020 is $19,500, plus an additional $6,500 if you are over 50 years old.

The 401(k) is the most advantageous when it comes to saving and allows you to save the most amount of money per year. The downside to a 401(k) is that the investments available through the company plan are very limited. The company will have a provider such as Fidelity, Schwab or Vanguard, and these firms will provide a list of funds from which you will be able to choose. Many times, there will be a financial adviser assigned to help navigate you in choosing what is best for you.

So now the big question is: How am I going to be able to afford to put money in my retirement account? I think the easiest and most successful way is to set up an automatic debit from your bank account. In other words, almost have it as a bill you pay every month. It doesn’t matter if it’s $50 or $500—every little bit helps, and it will add up. And if it’s automatically withdrawn from each paycheck, you won’t even miss it.

In the past, I’ve worked with professional athletes, who typically make much more money with endorsements than their salaries. I once did a special for ESPN regarding retirement planning where I suggested these athletes live off their salaries and save all their endorsement income, setting it aside for retirement. When I think about professional sport-fishing captains and crews, they can utilize a similar strategy. Try to live off your base salary, and save your tips, mount money, tournament winnings, side work and bonuses for retirement. I’m not suggesting being a miser—you have to enjoy the fruits of your labor—but this strategy can make a huge difference and really help you start setting money aside.

Read Next: What to do with that cash if you win it big in a tournament.

There are a few issues that you should be aware of when it comes to retirement planning. Not many captains and crews run boats on a daily basis into their late 60s or 70s. It’s a physically tough and very demanding career. It’s also a career of love, not money. Our social security system is flawed, to say the least. Many of the older crewmembers will probably receive a good portion of what they have already paid into; the younger generation, well, we can only hope they receive the benefits that they have paid already. Saving a few bucks each month will go a long way in helping you pay the bills when it comes time to retire. And it’s better to start now than wait until its too late.

I challenge all of you, whether you are captains, crew, anglers or owners, to meet with a retirement planner and CPA to discuss the best plan of action that is right for you. No two people have the same approach, goals and aspirations.

Please note that Barclay Breland Family Office does not provide tax advice, although we work closely with top tax attorneys and CPA firms. For specific needs or questions, please consult your tax adviser.